Asteroid Mining Market To Be Worth $3.9bn By 2025 Is Asteroid Mining Worth It

|

2nd July 2019 Asteroid mining market to be worth $3.9bn by 2025

Ongoing and future space missions, rising investment in new mining technologies, and use of materials obtained from asteroids in 3D printing will drive the growth of the asteroid mining market, according to Allied Market Research.

The recent demise of Planetary Resources and Deep Space Industries has led some in the futurist community to doubt that asteroid mining can become a reality anytime soon. These two companies had spearheaded efforts to unlock the vast metal and mineral reserves of our Solar System and were covered on this blog for several years. Planetary Resources ran into financial troubles caused by "delayed investment", with its human assets being purchased by ConsenSys, a blockchain software technology company. Less than three months later, Deep Space Industries (DSI) was acquired by Bradford Space, Inc. In retrospect, it is now obvious that both Planetary Resources and Deep Space Industries had arrived too early – before a sufficient infrastructure was in place to make their ideas a mainstream success, and relying entirely on venture capital.

There is reason for hope, however, as other companies are stepping forward with new proposals. These players now include Asteroid Mining Company, iSpace, Kleos Space S.A., Offworld, Sierra Nevada Corporation, SpaceFab.US, and Virgin Galactic. Added to that list is the aforementioned Bradford Space, Inc. Although no longer focused on mining as their primary objective, Bradford continues to develop spacecraft based on the earlier designs by Deep Space Industries, with potential to be adapted for use in future asteroid prospectors. A detailed analysis of the market for space resource utilisation – published by – finds that it generated a sum of $712 million in 2017 and is likely to reach $3.9 billion by 2025, growing at a CAGR of 24.4% from 2018 to 2025. Numerous missions by the government and private sector, growing R&D investments in space mining technology, and the use of asteroid-derived materials in 3D printing will drive this growth, according to Allied. The report is divided by three phases: spacecraft design, launch, and operation. As of 2017, the "design" segment accounted for four-fifths of the total revenue and is expected to continue its dominance through 2025. However, the "operation" segment will grow at the fastest CAGR of 29% by 2025, due to a surge in investment by public and private stakeholders. The current high cost associated with space mining impedes the market growth – but the adoption of in-situ resource utilisation methods, along with missions to study the Moon's surface, are expected to bring new opportunities to the market.

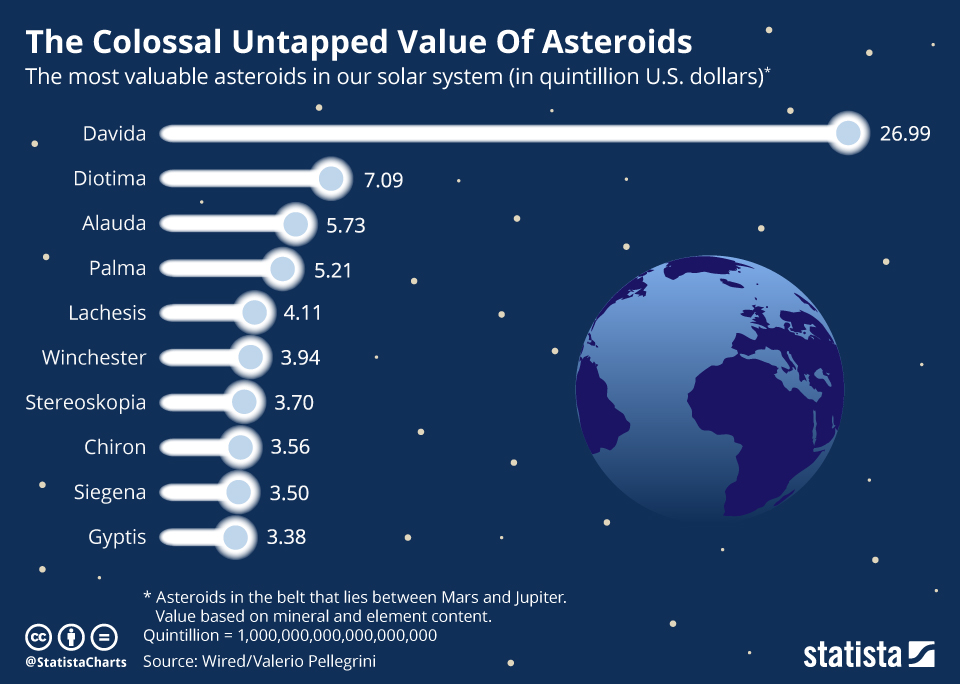

Allied Market Research also provides a breakdown of investment by asteroid types (Type C, Type S, Type M, and Others). In recent years, R&D has been mostly focused on C-type asteroids, which are carbonaceous chondrite bodies containing significant quantities of water. Over the next several years, attention will switch to M-type asteroids, according to Allied, which contain highly valuable resources such as platinum, gold and silver. One such asteroid – – is believed to contain metals worth a staggering $700 quintillion ($700,000,000,000,000,000,000). NASA is sending a probe there in 2022. North America accounted for nearly one-third of the market in 2017 and is likely to maintain its lion's share through 2025. However, growing technological capabilities and investments by countries in Latin America, the Middle East, and Africa (LAMEA) will see these regions achieving the highest CAGR of 26.4% during the study period. "You can't just think of space mining as something that will suddenly happen in 25 or 50 years," said Scott Moore, CEO of EuroSun Mining, in an interview with Mining.com. "It's already happening from an investment perspective." » |

0 Comments

Posting Komentar